Pretty much title. I’ve seen this talked about a lot but I only very vaguely know what all this means, could someone elaborate on what happened, why it happened and what the consequences of it are?

Pretty much title. I’ve seen this talked about a lot but I only very vaguely know what all this means, could someone elaborate on what happened, why it happened and what the consequences of it are?

as others are saying in the other posts, it’s about the cost to borrow money or the “time value of money” (cash in hand today is worth more than the promise of cash later). these are central features of a capitalist system: the notion that money must move and generate value, that lenders should charge interest. these ideas existed in eras prior to the capitalist mode of production, but under capitalism, especially neoliberal capitalism, there is no jubilee/forgiveness or moral constraints on lenders accumulating great wealth.

under US capitalism, the central bank (US federal reserve) is independent of any democratic control (it is a private entity) that sets the federal interest rate. this is the rate at which large, commercial banks can borrow money from the federal reserve. commercial banks make money by loaning money to private individuals, companies, etc and then charging interest. the interest rate the commercial bank charges will be higher than the rate of interest the commercial bank pays to the central bank so the commercial bank can turn a profit. so the central bank rate sets the pace for how much interest is charged to borrow money (i.e. how much it “costs”) in the broader economy.

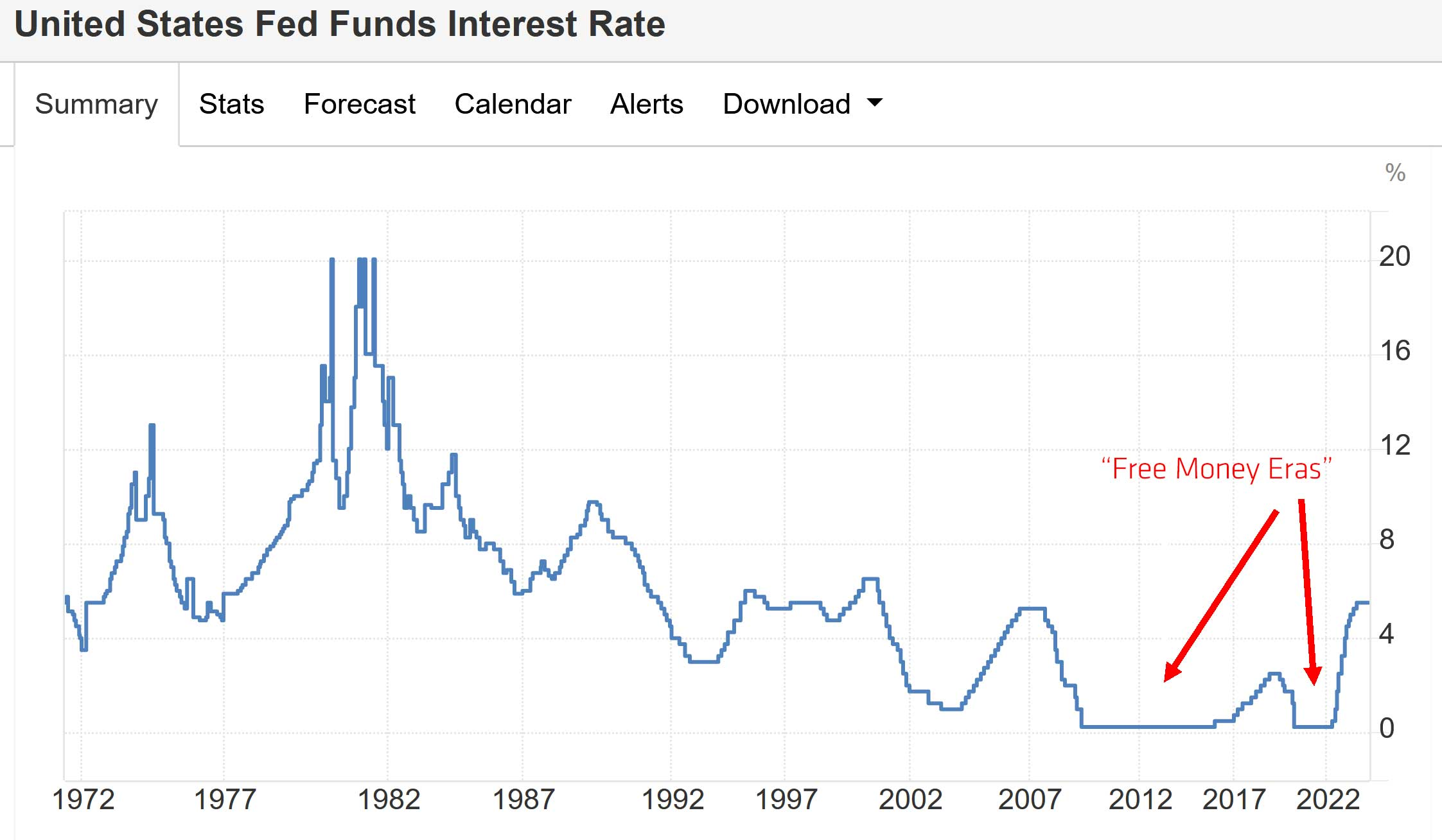

Here’s an image of “historic” interest rates with callouts for when bozos like me are referring to “free money” times.

the most common activity this affects is buying a car or a home, because normal people don’t carry around like $20k for a car or $200k in a bank account. so if you bought a house in 2021, had great credit, and a good down payment, and the term of the loan was 30 years, your interest rate was probably like 2.75%. if you bought a house today, with the same everything, the interest rate might be 6%.

the difference between those two rates over 30 years is stark. to make the math simple, maybe in both cases, you only needed to borrow $100k to buy the house. at the lower rate, over 30 years the payback on the loan would be $146,966.83 [borrowing $100k would “cost” you $46,966.83 in interest over 30 years]. at the higher rate, the payback on the loan would be $215,838.19 [borrowing $100k would “cost” you $115,838.19 in interest over 30 years].

I think it’s worth pointing out the difference in monthly payments for the loans in your example, those payments would be $408.24 at 2.75% interest and $599.55 at 6% (the payback amount divided by 360 months). So a higher interest rate means people have to pay more for housing.