How stupid do they think China is

It is funny that this supposedly “market-based” solutions boil down to an axiom that creditors should never be allowed to lose when making a bet or a loan, and that the state should always compensate creditors.

That’s basically the IMF’s whole bid too, the west created a whole global institution to create loans that can never lose, their goal is debt trap.

Which is ironic considering the capitalists rhetoric around loans and interest is that riskier loans have higher interest because of the chance of default. Then they go and ensure that no loan is risky if it’s enough money owed to the right people.

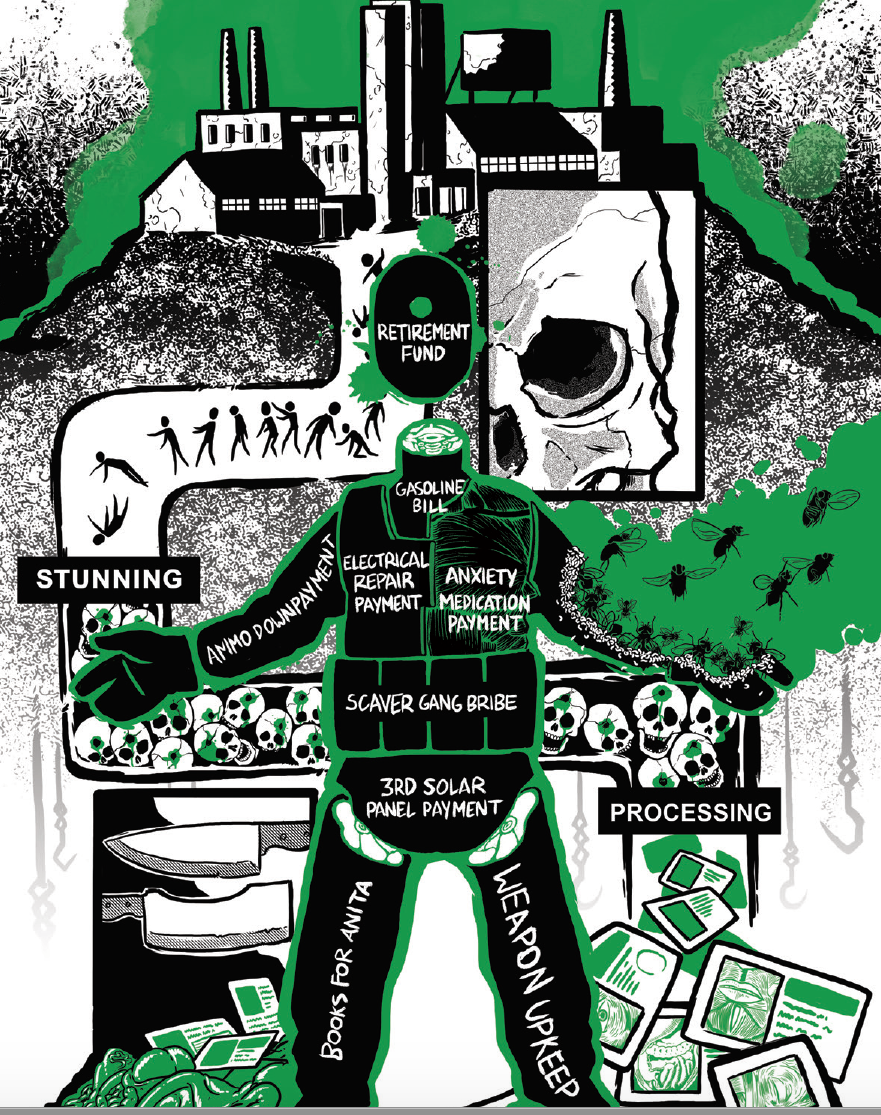

Michael Hudson has written about this, that the international loan system exists so that the imperial core can put the screws on the “developing” world whenever it makes political economy decisions that threaten international capital’s bottom line.

Yup! I read Super-Imperialism and then shortly after read Debt: The First 5,000 years, and I think they compliment each other really well in being able to conceptualize how debt is wielded as a weapon.

Debt actually opens up with the example of how “incredulous” of an idea it is that a country would default on their IMF loan and then shreds it apart.

The freeeeeeeeee marketttttttttt

The IMF wasn’t even offering to loan any money out, they were just telling China how to run their economy lmao

Trying to get China to debt trap the central government to the real estate capitalists themselves essentially

China

IMF

IMF

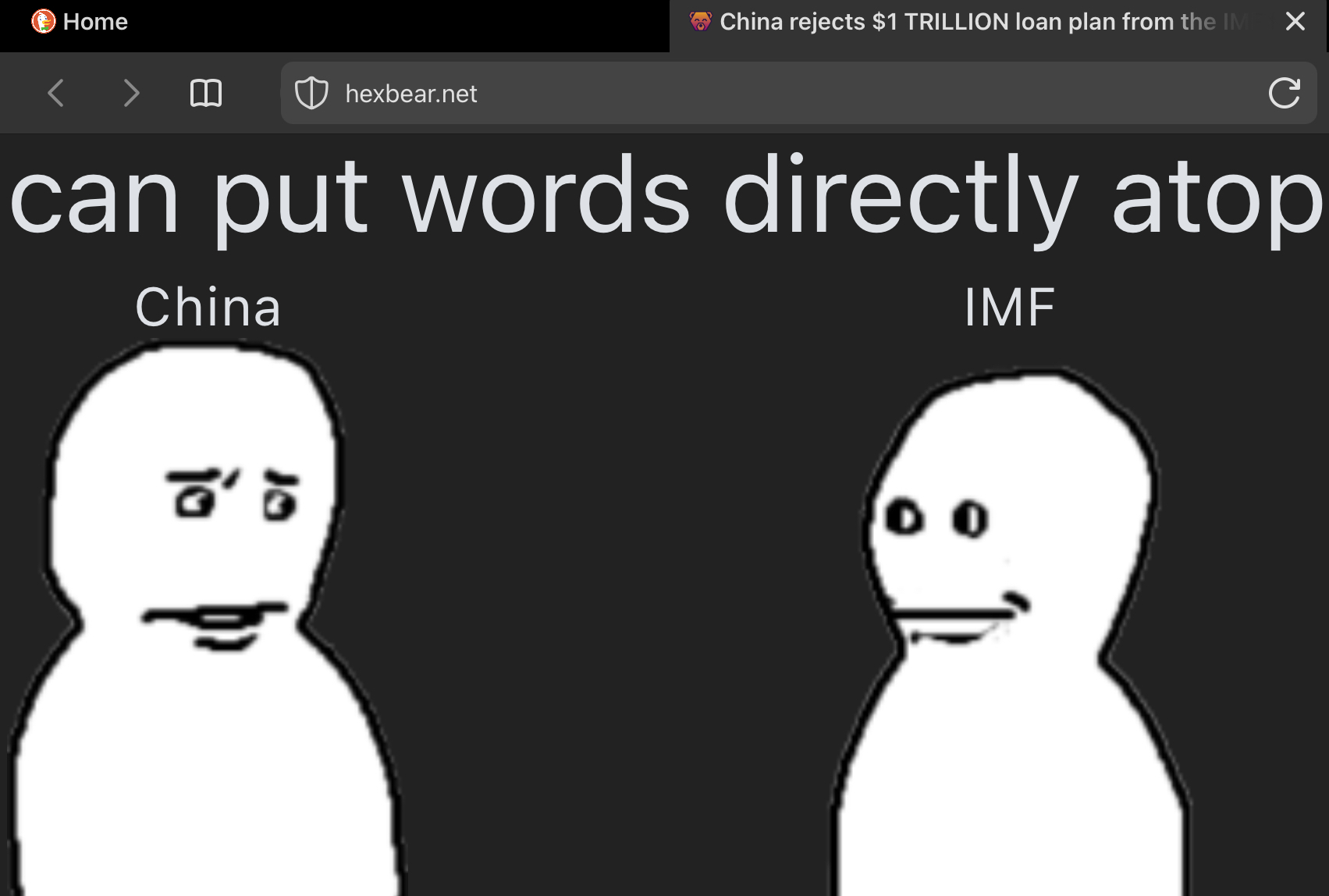

can put words directly atop emoji with

{emoji|text}and not have to try manually spacing

*edit - was unaware browser support mixed, YMMV

fwiw it doesn’t render correctly for me on desktop firefox, can only read the words by highlighting them

oof

in Chromium and Safari looks like

On ddg on iOS it didn’t even render at all for me lol

odd, works in iOS ddg and firefox here

Ohhh new tricks to power up the shitposting! Thank you 😊

Neat trick, but it’s rendering wrong for me

unfortunate, but that makes this one you just did even funnier

I’ve made a handful of shit posts with that newish furigana feature, but didn’t even think of using it with emoji.

next level shit

next level shityou mean

The IMF called on China to deploy “one-off” fiscal resources to complete and deliver pre-sold properties or compensate homebuyers, according to an annual review of the world’s second-largest economy published Friday. It put the cost at the equivalent of 5.5% of gross domestic product over four years.

That would amount to almost $1 trillion based on last year’s GDP, according to Bloomberg calculations.

Bloomberg made up the $1 trillion figure

“This would amount to INFINITY PLUS ONE TIMES A HUNDRED dollars.”

Ancient Chinese or Greeks would use “10000” for that figure of speech but it would look silly for US oligarch.

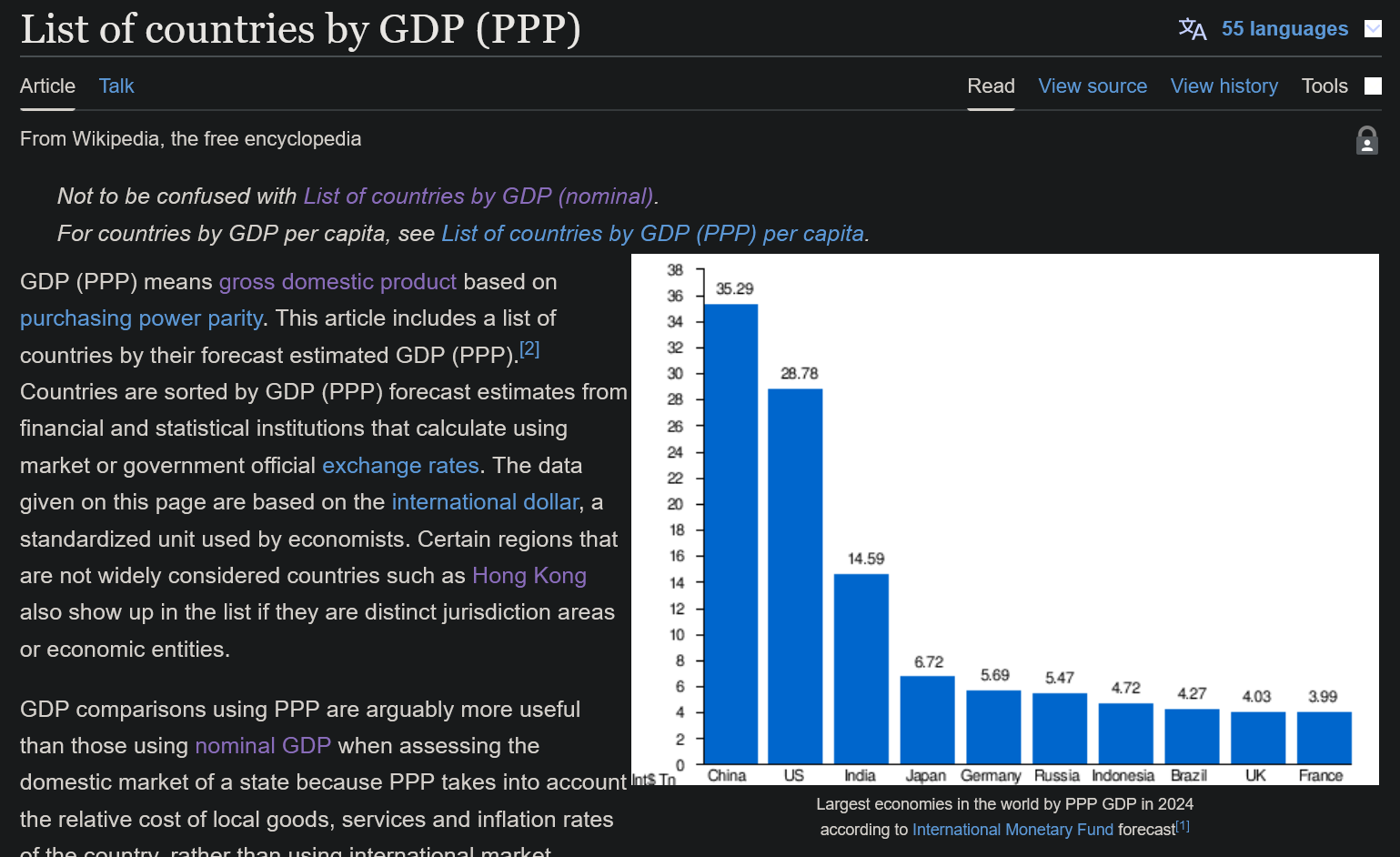

an annual review of the world’s second-largest economy

What weird hollywood accounting are they using to put China’s economy behind amerikas lmao

Using nominal GDP instead of GDP adjusted for purchasing power parity (PPP). America still leads in the former because the same goods and services cost more there than in China.

this is also the same neat trick they use when they say Italy’s economy is bigger than Russia’s

“We believe that we should continue to apply market-based and rule-of-law principles in completing and delivering these units,” said Zhang Zhengxin, the IMF’s executive director for China who was elected to the fund by the government in Beijing.

Lol. Just lol. “Actually we’re just gonna do capitalism and see how that works out”.

One of the many downsides of getting too many people educated in westoid universities

They should take the money and just give it to Palestine. Then when the imf guy comes to ask for a payment they should arrest him and put him on their space station where we can’t get to him

No fair, why should IMF ghouls get to go to space for free?

Just like all imf business the cost is free upfront, it is getting out at the end that is gonna cost.

Even if they were interested in injecting money on the companies that lost a shitton of money; doesn’t China have like a shitton US debt that they could call? Why would they get a loan for it?

US treasuries have a fixed coupon schedule, so they can’t be “called.” They can be sold for liquid cash though.

Ok, that then

deleted by creator

Aren’t the Chinese right here? Their property market is operating under capitalism, and if you bail out capitalists it does create a moral hazard for them to keep re-creating the conditions for more bail-outs. It would also send the signal that capital is actually in charge, and not the CPC.

My understanding is that the CPC wants to use this opportunity to increase the share of social housing, but as you said is attempting a controlled demolition of the market; trying to thread the needle between saving “regular” people who invested in real-estate and allowing the whole thing to collapse. It seems like a daunting task, but China might be the only country that could pull it off. Plus there’s the added benefit of greatly reducing the power of any real-estate ghouls left in government after the anti-corruption campaigns.

deleted by creator

how the fuck is the imf even in china to begin with

The IMF called on China to deploy “one-off” fiscal resources to complete and deliver pre-sold properties or compensate homebuyers, according to an annual review of the world’s second-largest economy published Friday. It put the cost at the equivalent of 5.5% of gross domestic product over four years.

That would amount to almost $1 trillion based on last year’s GDP, according to Bloomberg calculations. It’s a solution that China all but ruled out in an official response included in the report.

“We believe that we should continue to apply market-based and rule-of-law principles in completing and delivering these units,” said Zhang Zhengxin, the IMF’s executive director for China who was elected to the fund by the government in Beijing.

IMF:

Heyyyy buuuuudy! It’s me, the West, your old pal that you have a good history with who never says openly that we want to sew the seeds of your destruction. You know that thing that you’re being so successful at? Yeah, the economy! Looks like you need some help with that, wanna borrow some money?

Heyyyy buuuuudy! It’s me, the West, your old pal that you have a good history with who never says openly that we want to sew the seeds of your destruction. You know that thing that you’re being so successful at? Yeah, the economy! Looks like you need some help with that, wanna borrow some money?China:

I am the one who loans.

I am the one who loans.it is my understanding that they announced and even planned to divert resources away from real estate

why would they want to reinvest in it again all of a sudden in the first place

The way I’m reading this, it sounds like the IMF was just telling China how to use its own funds.