Can’t even imagine an American government doing this

the US liquidating Blackrock

This always needs to be done, the question is how do you handle this delicate balance without screwing things up, because way too much capital investments are now tied up in the real estate sector.

According to some calculations, the real estate sector now weights >20% of the GDP growth in China if you take into account all the other non-related companies that have also invested in real estate. One false step and a lot of those companies will go insolvent.

I wrote an entire comment here about China’s real estate bubble and why it is such a challenging problem for China (spoiler: no, it won’t collapse lol, but there’s no easy solution either).

This is why China staying as a net exporter country (instead of an internal circulation i.e. domestic consumption model) always going to be a dead end. If they had transitioned decades earlier, they wouldn’t be in this situation right now.

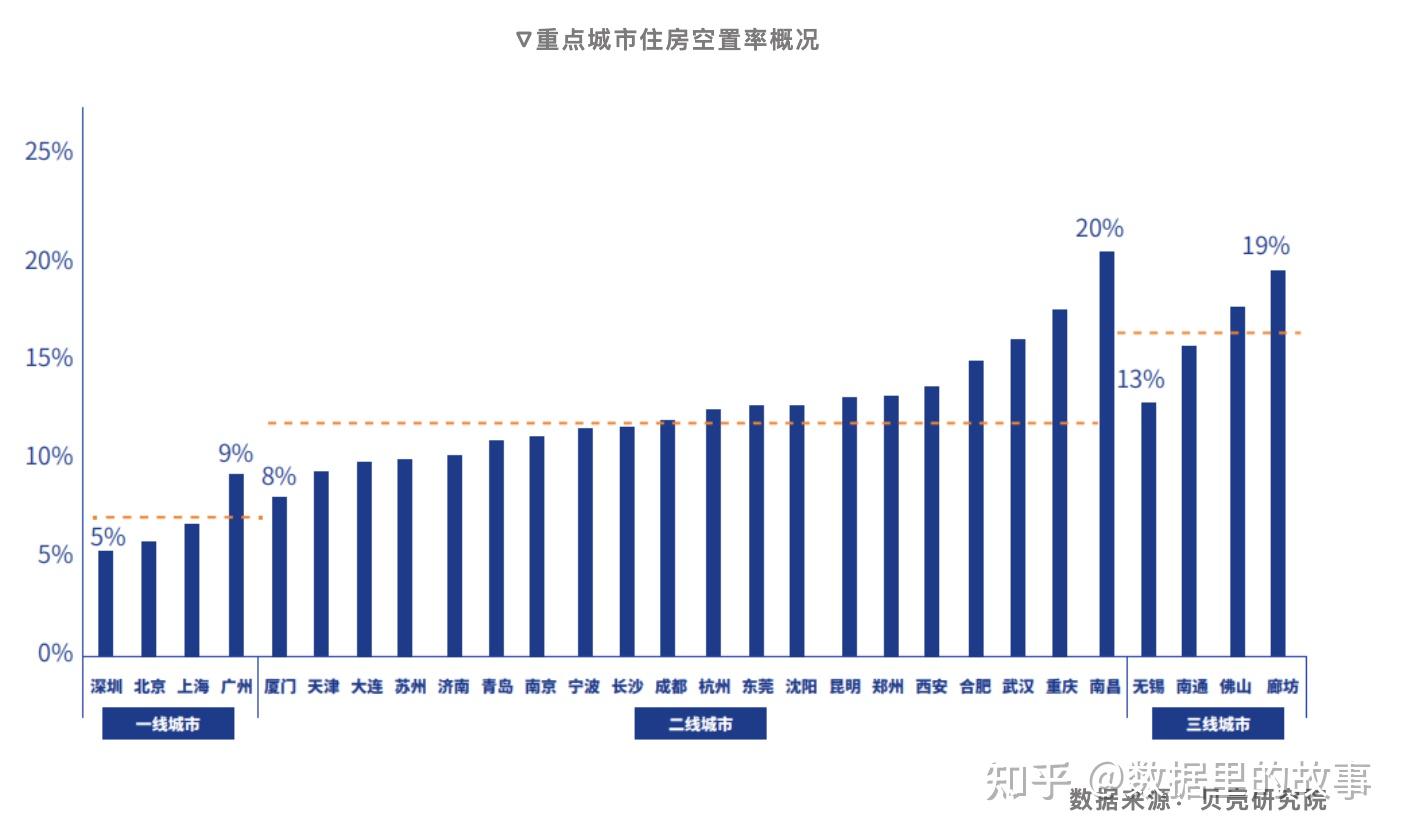

Why do you repeat the redditor-YT thumbnail tier “China has built enough housing for 6 billion people” thing in that comment. Its a completely unserious claim that comes from no credible source or analysis, domesticaly or abroad and is diectly contradicted by any actual numbers of Chinese construction. Its for redditors to circlejerk over in the comments when watching some demolition video of high rises in China and pretend China has ovebuild by 100% or more. Latest vacancy numbers show that residential Vacancy rates are between 7 to 23% with an average of around 13%. Higher on low tier cities and lower in Tier 1 cities. There is overbuilding but if you wanna aim at a “healthy” 5% that means that China has overbuilt by 8% and thats some dead GDP of idk a 4 trillion over a decade or whatever. But again China still has a lot room to go in urbanization rates , especially now that growth is concentrated in tier 2 and bellow cities so unless you believe that China tops out at 65% urbanization rates - of which 20% are still not even full urban hukou holders, even that overbuilding isnt as definitive in the “will never be occupied and used” territory

You make these well thought out comments and analysis but you sometimes include something so non-credibly anti-china tabloid slop that it sours the whole thing . Do you actualy believe that like of 70% of all residential buildings in China right now are empty housing or some unfinished high rises?. Be real

All of the information I have posted came primarily from Wen Tiejun’s video series on the topic (Part 1, 2 and 3). If you can understand Chinese you should check them out yourself, since it is a very educational and informative series. I’ve been meaning to translate all of them but never found the time.

There are more than 800 million property units in the urban area as we speak - that’s more housing than there are people in the entire urbanized population of China, even if we give every single person their own individual housing unit! And that’s not counting the large amount of completed commercial properties in the rural area over the last few years that totaled about 900 million square meters. That’s a huge amount of real estate properties.

And I’m sorry I trust a Chinese Marxist economist who is actually an expert on land reform and land enclosure in China more than any Western sources.

800 million property units

First of all what classifies as a “property unit” ? 800M property units doesnt equal 800M housing units. Offices, stores, garages, hotels. Its anything really. The numbers im seeing are 400 million Housing Units in Urban ereas, less than half of the urban population, with 60 Million Empty/vaccant/mid construction, which lines up both with the vaccancy rates i mentioned and with 800M total property units. How many “housing units” does the proffessor claim there are in urban China and what is the vaccancy rate on them, and what if any chinese survey or source there is on those numbers if he actualy claims them ?

Im trying to use Chinese sources at best i can but nothing seems to agree with anything close to 800 M urban housing units at 30+% Vacancy rates . Survey and Research Center for China Household Finance has total urban vacancy rates plateuing at ~20% of 300+M housing units in 2017. More recent surveys like this point out at decreasing vaccancy rates that now sit more in line with the numbers i mentioned. This includes housing units that are vacant for more than 3 months and excludes unfinished units. The numbers should be 2-3% higher than this but still that puts it comfortably bellow 20% overall as of now.

At worst urban overbuilding doesnt seem to go above 10% of tottal units build compared to most mature economies

I found YouTube links in your comment. Here are links to the same videos on alternative frontends that protect your privacy:

Link 1:

Link 2:

Link 3:

HA